Superbowl Monday (aka the St Valentine's Day Masacre)

Happy Valentines Day. I hope that the Men didn't forget and the ladies are preparing for March 14th, the worlds greatest holiday

http://www.steakandbjday.com/

Fire up his loins and fire up the grill all on one magical March evening.

Congratulations to the Superbowl Champs the Los Angeles Rams. I hope all of your bets hit and that no one got too intoxicated yesterday. Some takeaways from the big game:

1) Crypto currency commercials feel a lot like the 2000's dot com bubble

2) The Soprano's Chevy Silverado commercial hit me in all of the Jersey Feels

In Broader Market News, the Dow Industrials closed down 171.89 or 0.49% to end the session at 34,566.17, the real S&P closed the session down 16.97 points or 0.38% to finish at 4,401.67 and the Naz closed down slightly as traders sold that index off 0.24 points or .0017%. Over in the bond markets, prices fell 2.1% and yields rose to 1.99% on the 10 year treasury as bond markets are starting to price in rate tightening at the fed during the next FOMC meeting. It is my view that inflation is still transitory in nature and a result of the supply chain crisis that just won't end but that a modest rate hike at the Fed will lead to the unwinding of some of the more speculative positions in the market (I'm looking at you NFT's, Crypto, Baseball Cards, Peety, and other worthless assets that are still getting priced to astronomical valuations).

On inflation, I believe that a large portion of the demand side of inflation will wind up closing out of the market. I belive that at some point all of the kinks in the supply chain will work themselves out and commerce will continue unabated in the US economy

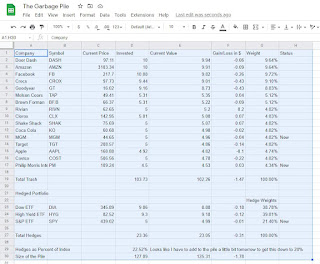

The garbage pile is growing yet again. Positions were added to in Goodyear, Crocs, Doordash, Amazon and Meta. New positions were added in MGM Resorts and in Philip Morris International (sue me, I'm a sinner). The hedged side of the garbage pile was added to in the real S&P etf

Here is how high the garbage pile is now

Total pile value $125.31 off of $127.09 invested a loss of $1.78 or 1.4%

In the news from the pile:

Over at JP Morgan, the analyst covering industrials likes a bargain just as much as I do and upgraded Goodyear as it rallied in the ally $0.25 or 1.55%:

Meta's stock has never been cheaper according to Barron's

Rivian had a decent day on the late Friday news that Billionare and Conservative boogey man George Soros took an interest. The stock closed up today $3.8 or 6.46%

Clorox is still a boring old industrial conglomerate who's breakup value is probably worth greater than the sum of it's parts. (In other words no news)

Shake Shack landed on Wedbush Securities best ideas list (in other news, who the fuck is Wedbush Securities and why the fuck should I care what they think)

Coca Cola traders have begun pricing in it's annual dividend increase driving the stock up 0.39 or 0.65% outpacing the market in beverage stocks

Target's CEO is the latest boy to cry wolf on inflation although I am left to question if they count Instacart and Shipt shopper visits as unique or same store visits?

Is Apple going to get into the social media business? News at 9:31

Filed under the who gives a rat fuck files, here is what CNN thinks is legitimate business news about Costco

So that's it, I hope everyone gets laid, everyone gets paid, and that your garbage pile performs better than mine. A call out to my readers, if you have your own garbage pile portfolio and would like to be a once a week guest post, email me at jason.sansone@gmail.com and we will talk.

Lean into the awkward, uncertain, and crazy and let's all get paid bitches

http://www.steakandbjday.com/

Fire up his loins and fire up the grill all on one magical March evening.

Congratulations to the Superbowl Champs the Los Angeles Rams. I hope all of your bets hit and that no one got too intoxicated yesterday. Some takeaways from the big game:

1) Crypto currency commercials feel a lot like the 2000's dot com bubble

2) The Soprano's Chevy Silverado commercial hit me in all of the Jersey Feels

In Broader Market News, the Dow Industrials closed down 171.89 or 0.49% to end the session at 34,566.17, the real S&P closed the session down 16.97 points or 0.38% to finish at 4,401.67 and the Naz closed down slightly as traders sold that index off 0.24 points or .0017%. Over in the bond markets, prices fell 2.1% and yields rose to 1.99% on the 10 year treasury as bond markets are starting to price in rate tightening at the fed during the next FOMC meeting. It is my view that inflation is still transitory in nature and a result of the supply chain crisis that just won't end but that a modest rate hike at the Fed will lead to the unwinding of some of the more speculative positions in the market (I'm looking at you NFT's, Crypto, Baseball Cards, Peety, and other worthless assets that are still getting priced to astronomical valuations).

On inflation, I believe that a large portion of the demand side of inflation will wind up closing out of the market. I belive that at some point all of the kinks in the supply chain will work themselves out and commerce will continue unabated in the US economy

The garbage pile is growing yet again. Positions were added to in Goodyear, Crocs, Doordash, Amazon and Meta. New positions were added in MGM Resorts and in Philip Morris International (sue me, I'm a sinner). The hedged side of the garbage pile was added to in the real S&P etf

Here is how high the garbage pile is now

Total pile value $125.31 off of $127.09 invested a loss of $1.78 or 1.4%

In the news from the pile:

Over at JP Morgan, the analyst covering industrials likes a bargain just as much as I do and upgraded Goodyear as it rallied in the ally $0.25 or 1.55%:

Meta's stock has never been cheaper according to Barron's

Rivian had a decent day on the late Friday news that Billionare and Conservative boogey man George Soros took an interest. The stock closed up today $3.8 or 6.46%

Clorox is still a boring old industrial conglomerate who's breakup value is probably worth greater than the sum of it's parts. (In other words no news)

Shake Shack landed on Wedbush Securities best ideas list (in other news, who the fuck is Wedbush Securities and why the fuck should I care what they think)

Coca Cola traders have begun pricing in it's annual dividend increase driving the stock up 0.39 or 0.65% outpacing the market in beverage stocks

Target's CEO is the latest boy to cry wolf on inflation although I am left to question if they count Instacart and Shipt shopper visits as unique or same store visits?

Is Apple going to get into the social media business? News at 9:31

Filed under the who gives a rat fuck files, here is what CNN thinks is legitimate business news about Costco

So that's it, I hope everyone gets laid, everyone gets paid, and that your garbage pile performs better than mine. A call out to my readers, if you have your own garbage pile portfolio and would like to be a once a week guest post, email me at jason.sansone@gmail.com and we will talk.

Lean into the awkward, uncertain, and crazy and let's all get paid bitches

Comments

Post a Comment