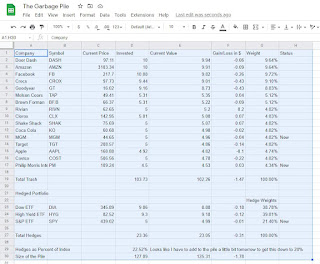

Garbage Pile Status

Hello Readers, It has been a few minutes since I have posted an update on the size and composition of the garbage pile. Since my last post the market has undergone a lot of turmoil. Putin has invaded Ukraine and the Markets have reacted appropriately. Vladimir Putin is a pariah on the international stage and the Russian capital markets are in turmoil. The Ruble is colapsing as expected and their stock market is down over 50% since the invasion. In the garbage pile, I have added new positions in a bunch of places. Notable new positions include both Bank of America, and JP Morgan Chase as both of their stocks suffered significant declines on the invasion of Ukraine. The garbage pile had Disney added but a significant portion of the holdings are gifts for my niece Avery who turned 6 recently and I decided that I wasn't going to buy her legitimate worthless crap, only paper that may at some point in the future prove to be worthless (but it's Disney so probably not). The Garbag